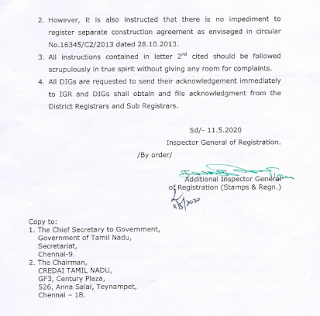

Real Estate Update (Tamilnadu):

In projects where undivided share or land (UDS) is

transferred to the buyer by the owner and separate agreement is entered for

construction -

-

Inspector General of Registration, Tamilnadu has clarified that stamp duty

shall not be demanded

on the value of building and shall be restricted only to sale of UDS

- This

is applicable for first sale of UDS including projects where completion

certificate is issued by the competent

authority

- No

bar on registering separate agreement for construction between the buyer and

builder

(Reference Letter No. 11672/C2/2020 dated 11 May 2020)

No comments:

Post a Comment